Join ASA’s Houston Chapter for its 2021 Energy Valuation Conference

Join the Houston Chapter of American Society of Appraisers for its 11th Annual Award Winning 2021 ENERGY VALUATION CONFERENCE on Wednesday May 12, 2021 in a convenient VIRTUAL live webcast provided by Business Valuation Resources (BVR).

The HOUSTON 2021 ENERGY VALUATION CONFERENCE brings together pre-eminent energy valuation professionals and industry thought leaders presenting timely educational topics, including comments on the industry’s Post-COVID Energy Outlook. Featured speakers represent all sectors of the energy industry offering a variety of perspectives in business valuation, machinery & technical specialties, new accounting developments, appraisal review & management, real property, and more.

What makes energy valuation so important to appraisers?

This very dynamic and cyclical industry affects all cities around the world. Even if your client isn’t an energy company, energy can still play a vital role in its performance, cost structure and profitability.

What will attendees take away from 2021 EVC?

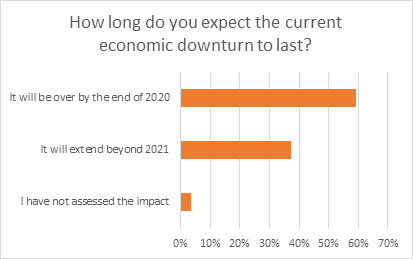

A better understanding of the current economic and geopolitical conditions of the industry, and learn perspectives on challenges in energy valuations in this economic slump and COVID environment, including which sectors will return and when. EVC is a very holistic and well-rounded conference that attendees enjoy and learn from – not just appraisers. Our goal is to expand our outreach to include those in related professional groups and industry associates.

About the Energy Valuation Conference?

More than 200 professionals & executives from across the United States and countries as far and wide and diverse as Brazil, Kazakhstan, and Canada joined to gain a better understanding of the current economic and geopolitical conditions of the industry. Attendees were able to engage with the leaders to and discuss solutions to complex challenges faced by investors and clients during these volatile and challenging economic times. The broad-ranging conference enabled opportunities to interact with key players from various segments of the value chain: downstream, midstream, upstream, upstream, and emerging trends in the growing renewables sector. EVC is a very holistic and well-rounded conference that attendees enjoy and learn from – not just appraisers.

Houston’s 10th Annual Award Winning EVC was widely attended by accountants (27% CPAs); ASAs Accredited in Business Valuation (36%), Machinery & Technical Specialties (17%) and ARM, PP, RP, GJ (7%); CFAs (7%), and petroleum industry professionals (7%).

Why Attend?

Do you have clients in the Energy Industry?

- “I will say that it was just as top-notch as it gets. The content was superb and the smooth tech operations really made it one of the best virtual events I’ve attended yet. Your speakers and sessions were, truly, spectacular.”

Learn About the Outlook of the Energy Industry & Timeline of Recovery by Sector.

- “I thoroughly enjoyed the virtual conference – found it to be very informative and right on point given our current social and economic environment. The speakers were excellent and I look forward to attending next year’s conference – virtual or in-person.”

Speakers are Excellent & Well-Rounded Mix.

- “It was the best virtual format event I have participated in over the last two months (and honestly, pretty wide gap relative to second best).”

- Featured speakers were remarkable leaders from all sectors of the energy industry demonstrating a variety of perspectives in all disciplines: Business Valuation, Machinery & Technical Specialties, Appraisal Review & Management, Real Property, among other.”

Sponsor Benefits:

- EXCEPTIONAL OUTREACH: Your Logo included in emails to 6,000 professionals.

- Your LOGO and RECOGNITION included in (i) in Sponsor Power Point Slide Show that scrolls between speakers, (ii) on EVC Website, and (iii) in EVC Brochure.

- FREE REGISTRATIONS to online conference – click below to see more.

- LIVE LINK LOGO to your website on our EVC web page.