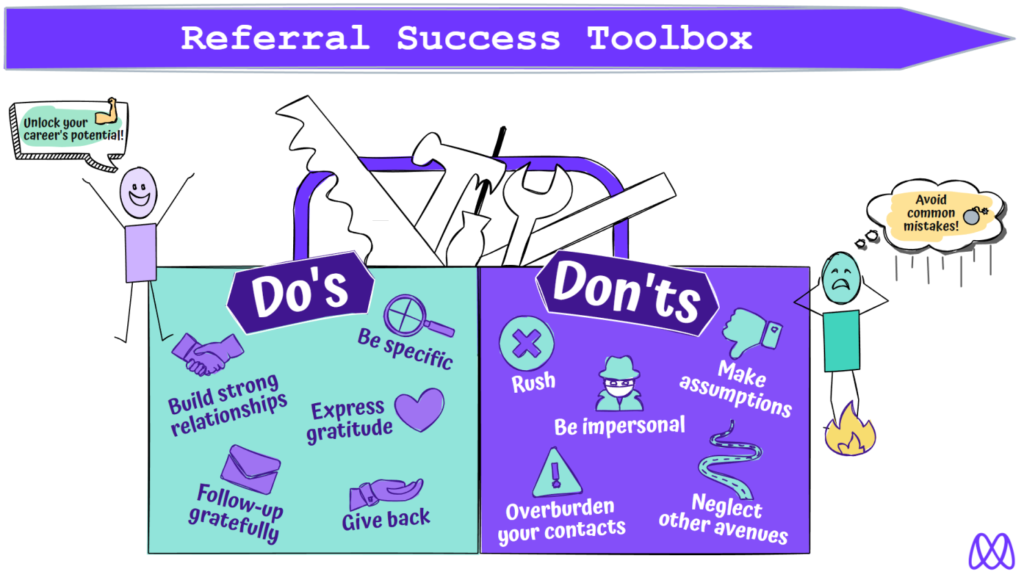

Referral Requests: Dos and Don’ts for Career Advancement

By Jessica Lopez as seen on LinkedIn.com.

Design Magic by Jessica López Aparicio © 2023

Editor’s Note: Referrals are one of the key benefits of belonging to a professional organization like ASA. Its multidiscipline network of member professionals offers a distinct advantage over other organizations. But how can members better improve their networking skills to capitalize on this? Review this insightful Dos and Don’ts article to learn more.

Did you know that in your career journey, referrals can be a game-changer? They’re like the keys that unlock doors to new opportunities. But there’s an art to asking for referrals that goes beyond the basics. Let me share some do’s and don’ts to help you master this valuable skill!

The Do’s of Asking for Referrals 🤝

1. Build a Strong Relationship First

Before requesting a referral, take the time to build a genuine and meaningful relationship with the person you’re reaching out to. Engage in conversations, express interest in their work, and show that you value their expertise.

Example: Suppose you’ve met a fellow developer at a conference who works at a company you admire. Instead of immediately asking for a referral, initiate a conversation about your shared interests in a specific technology or project. Build a rapport based on mutual passion.

2. Be Specific in Your Request

When asking for a referral, specify the type of job or opportunity you’re seeking and explain how the referral can benefit both you and the person you’re asking.

Example: If you’re interested in a front-end developer position at a particular company, specify the role, mention your relevant skills, and explain why you believe you’d be a valuable addition to their team.

3. Express Gratitude

Never forget to say “thank you.” When someone agrees to refer you, show your appreciation. A simple expression of gratitude can strengthen your professional relationships and leave a positive impression.

Example: After a colleague refers you for an exciting project, send them a heartfelt thank-you email or a small token of appreciation. It reinforces your professionalism and encourages further collaboration.

💡 Pro tip: While a single “thank you” is valuable, consider making gratitude a regular practice in your professional relationships. A follow-up note after a successful interview, a congratulations message for a contact’s accomplishment, or even a simple “checking in” email can go a long way in sustaining your connections.

Example: Suppose your referral led to a successful job interview. A week after sending your initial thank-you note, you hear that your contact has recently achieved something significant in their career. Take the opportunity to congratulate them, reiterating your gratitude for their initial help and expressing how happy you are to hear of their success.

4. Follow Up Gratefully

After someone has provided you with a referral, make sure to follow up with them and keep them in the loop about the progress. Express your gratitude again and let them know how much you appreciate their support.

Example: Imagine a former colleague referred you for a job at a prestigious software company. You successfully secured an interview and eventually got the job. After landing the role, send an email to your colleague, thanking them once more for the referral and updating them on your new position. Let them know that their support directly contributed to your career advancement.

5. Give Back to Your Network

Whenever you have the opportunity, reciprocate the favor by offering to provide referrals or assistance to those in your professional network. Building a culture of mutual support can strengthen your relationships.

Example: Suppose you’ve been working at your current company for a while, and a junior developer you’ve mentored expresses interest in a job change. You know of an opening at another reputable tech firm that aligns with their skills. You proactively offer to refer them for the position and provide guidance on the application process. This gesture not only helps your colleague but also reinforces the principle of giving back within your network.

The Don’ts of Asking for Referrals 🙅♂️

1. Avoid Premature Requests

One of the most common mistakes is asking for a referral immediately after connecting with someone. Building trust and rapport should always precede any referral request. Rushing this process can be counterproductive.

Example: Imagine you’ve just connected with a senior developer on LinkedIn. Instead of immediately requesting a referral for a job opening at their company, engage in conversations, share insights, and build a professional relationship over time.

2. Don’t Assume It’s Guaranteed

It’s vital to understand that referrals are not obligations but rather favors. Even if you have a strong relationship, not everyone may be in a position to refer you. Respect their decision, whatever it may be.

Example: Your close friend works at a tech startup, and you’re excited about an opening there. While your friend is happy to help, they may not know your professional strengths well enough to confidently refer you. Respect their decision and explore other avenues.

3. Avoid Being Impersonal

Sending generic referral requests rarely leads to positive outcomes. Tailor your message to each individual, demonstrating that you’ve invested thought and effort into the request. Personalization is key!

Example: You’ve identified a developer in your network who has experience at a company where you’d like to apply. Instead of sending a generic request, mention a specific project they’ve worked on and explain how your skills align with the company’s needs.

4. Don’t Overburden Your Contacts

Avoid asking for referrals too frequently from the same set of contacts. Repeated requests can strain relationships. Make sure your requests are well-timed and considerate.

Example: Imagine you have a close-knit network of professional contacts you often reach out to for various opportunities. Instead of repeatedly asking the same individuals for referrals, you space out your requests and prioritize the relationships where referrals align with the contact’s expertise and your qualifications. This approach ensures that you don’t overburden your contacts with frequent referral requests.

5. Don’t Neglect Other Avenues

Focusing solely on referrals should NOT be your primary job search strategy. While they can be valuable, don’t overlook other avenues like networking events, job boards, and online applications. Diversify your approach for a well-rounded job search.

Example: Suppose you’re actively seeking a new job opportunity. In addition to seeking referrals from your network, you also attend industry-specific networking events and conferences, regularly update your online portfolio, and actively apply to positions on job boards. By diversifying your job search efforts, you increase your chances of finding the right opportunity while not relying solely on referrals.

Unlock Career Advancement with the Right Tools.

Final Thoughts: Unlocking the Referral Advantage 🚪🔑

Referrals are more than just professional courtesies; they’re pathways to your career’s next chapter. Remember, it’s not just about asking for referrals; it’s about cultivating authentic connections and mutually beneficial relationships.

Remember, when someone provides a referral, their own reputation is on the line. They’re endorsing you, and they want to ensure that their recommendation aligns with your capabilities and character. Some may not feel comfortable providing referrals unless they’re genuinely confident in your abilities. Not every relationship you form is a referral conduit, and that’s perfectly fine. The path to success is rarely linear, and every connection, whether it leads to a referral or not, contributes to your growth.