2020 ASA Fair Value Virtual Conference – Fall Recap

On Wednesday, November 18th ASA held its highly anticipated Fair Value Virtual Conference – Fall.

With 169 participants, 8 stimulating sessions, and 14 unique session speakers, ASA broke Fair Value Conference attendance records by a whopping 34%!

This compelling conference brought together industry professionals from around the globe and covered a range of fair value measurement and valuation topics, as well as other current and future expected trends regarding the FASB, SEC and international accounting standards.

Anchored by thought provoking panel discussions, the conference included a variety of polls to offer insight from attendees on a variety of topics. Kicking off with the Current Issues Panel, headed by Carla Nunes, CFA, Jim Krillenberger, Adam Smith, ASA, and Paul Balynsky, CFA, CPA/ABV, attendees provided input on the continued challenges and impacts of COVID.

Methodology

The COVID-19 outbreak has caused unprecedented turmoil in financial markets and created a global economic recession. The associated heightened level of uncertainty had led many valuation professionals to rethink their valuation assumptions and methodologies.

During the conference, attendees were asked a number of polling questions regarding the assumptions being used and the adjustments being made in the current environment when performing fair value measurements.

The following is a brief overview of the population of survey respondents.

- Average number of survey respondents = 109

- Majority of attendees were in the United States, but the conference also attracted participants from Australia, Austria, Bermuda, Mexico, Romania, Saudi Arabia and Singapore

The remainder of this report documents the survey results.

“Current Issues” Panel

This session began with an introduction to the current economic environment and the apparent divergence with financial markets. Panelists then discussed a variety of issues that valuation professionals have been facing when developing fair value estimates in a post-COVID-19 environment:

- Impact of COVID-19 and U.S. Presidential Elections on fair value measurements related to: 1) goodwill and asset impairments; and 2) fair value updates of portfolio investments

- Incorporating uncertainty in cash flow projections: scenario approach and sensitivity analyses versus discount rate adjustments

- Impact of COVID-19 on cost of capital inputs: Risk-free Rate, Equity Risk Premium, Beta, Capital Structure, Alphas

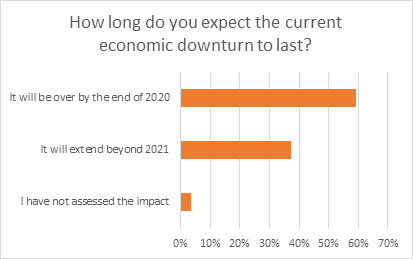

When survey participants were asked how long they expect the current economic downturn to last, nearly 60% replied they anticipate the current recession will end in 2020. The responses were in line with the expectation that a vaccine will be widely available in 2021. Some economists still believe that the recovery could be either V- or U-shaped, while eithers point to a K-shaped recovery, meaning that some companies/industries will outperform the overall economy, while others will continue to struggle until social distancing policies are no longer necessary.

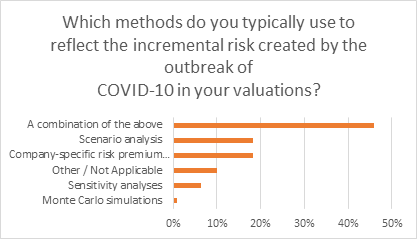

Survey respondents use a variety of methods to incorporate the incremental risk created by COVID-19 in their valuations. Almost half of the respondents use a combination of methods. For those relying primarily on a single method, practice seems to be equally divided (at close to 20% each) between those who prefer to use scenario analyses and those who adjust their discount rate with a company-specific risk premium.

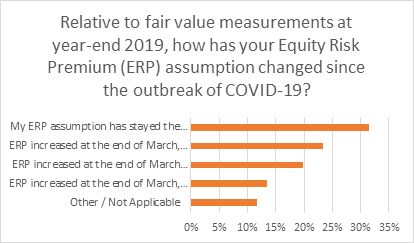

About a third of participants has kept the same equity risk premium (ERP) assumption since December 2019 when developing cost of equity estimates, which may reflect a preference by this sub-group to rely on historical ERP measures. Interestingly, almost 40% of respondents (combined) have either decreased their ERP assumption from the March 2020 levels or are considering doing so currently.

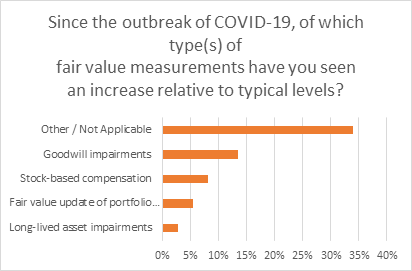

COVID-19 has led to an increase of certain types of fair value measurement projects relative to typical levels. On a stand-alone basis, goodwill impairments capture the most common type of projects seeing an increase in frequency, which is not surprising. Following the stock market collapse in March and April 2020, many companies identified triggering events that required an examination of whether their goodwill was impaired. More broadly, about two-thirds of respondents saw a rise in goodwill and long-lived asset impairments, stock-based compensation, and/or market-to-market updates of portfolio investments.

The Same Facts, Different Answers panel led by Bill Johnston, ASA-IA, Ryan Gandre, ASA, CFA, CEIV, Carla Nunes, CFA, Adam Smith, ASA, and Jacquelyn Marsac, CFA offered a reminder that valuation is not an exact science, and perspective can vary between individuals looking at the same economic environment and reviewing similar accounting guidance.

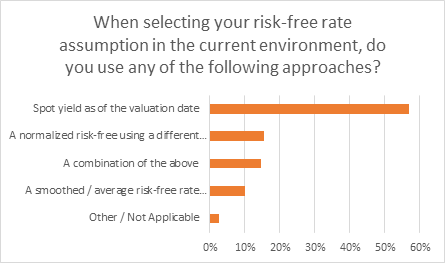

When asked about the risk-free rate assumption used in the current environment, a majority (57%) indicated that the spot yield as of the valuation date is the preferred approach. Some type of normalization, either by computing an average risk-free rate or a different normalizing method, was used by 41% of respondents.

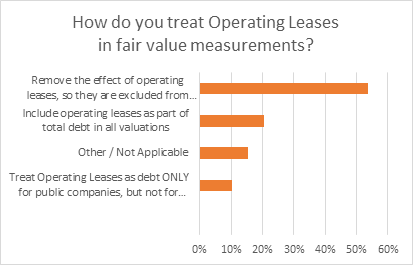

The accounting treatment of operating leases for publicly-traded companies has recently changed in both US GAAP and IFRS. This type of financing is now capitalized as an operating lease liability in companies’ balance sheets under both accounting standards (note that private companies have more time to adopt under US GAAP).

Survey participants were asked whether they treat operating leases as debt equivalents in their fair value measurements. Over half of respondents indicated they remove the effect of operating leases by excluding this liability from total debt, thereby approximating the old accounting rules. Just over 20% of respondents have in effect reflected the new leasing rules in their valuations, while 10% make a distinction when dealing with public vs. private companies.

Thank you to our Sponsor VRC – and thank you to everyone who helped make this virtual conference a success!

For more information about ASA, please visit appraisers.org.

You can follow any responses to this entry through the RSS 2.0 feed. Responses are currently closed, but you can trackback from your own site.

Comments are closed.